This year, Davenport University volunteers — including students, staff, faculty and alumni — will provide more than 10,000 hours of service through the Volunteer Income Tax Assistance Program, an IRS initiative that offers free income tax preparation for low income families.

More than 40 of the volunteers hail from DU’s accounting program. Some utilize VITA as an internship experience while others have found jobs within accounting after volunteering, according to Gregory Scholten, VITA Assistant Program Director and accounting adjunct instructor.

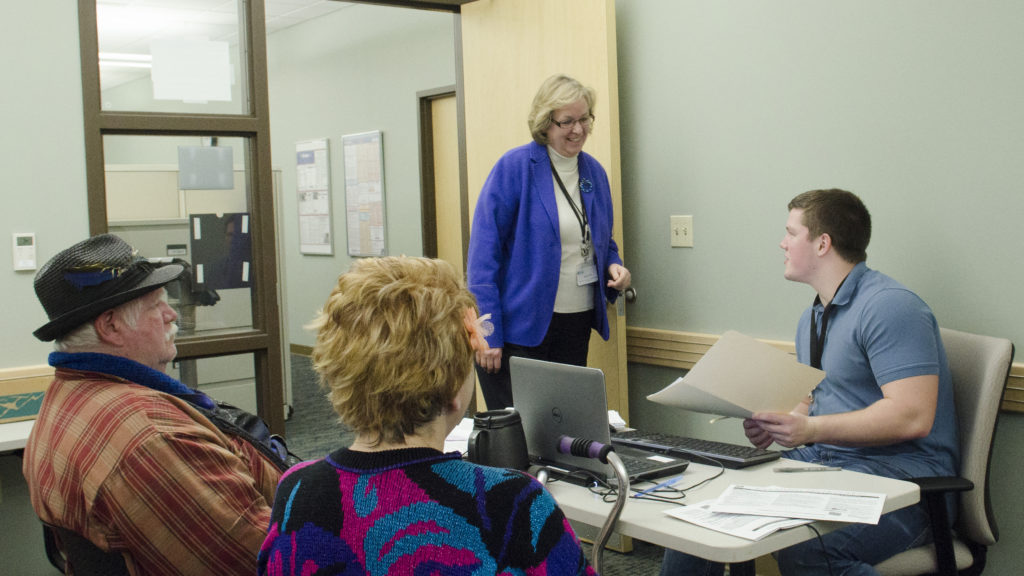

DU student Jacob Jaudes-Jablonicky believes VITA is an experience that every accounting major should have.

“VITA helped me land an internship at a reputable accounting firm,” Jaudes-Jablonicky said. “Without VITA, I don’t think I would have received that offer.”

The hands-on learning offered by VITA is key to the success of student volunteers, Scholten said. The experience builds transferable skills — such as time management, problem solving, organization, interviewing and communication.

“Students have one hour with clients, so they need to learn how to interview and quickly discern what information is important and what isn’t. They organize client documents, prepare the tax return and then must be able to communicate the financial results in terms our clients can understand,” said Judy Knapp, VITA Program Director.

There also are ethical situations DU students face, making VITA an invaluable professional experience.

“It’s so important for our accounting students to gain experience adhering to accounting standards and ethical principles,” Knapp said. “For example, if a client does not wish to report some income, the student volunteer learns how to uphold the tax law while tactfully approaching the situation.”

Impacting West Michigan communities

VITA is expected to serve 6,500 people throughout West Michigan this year and Scholten expects about $8 million to be refunded to clients.

“In the beginning, low income individuals did not know about VITA program and were therefore foregoing refund and credits,” Knapp said. “Over the years we have seen many tears of happiness because the taxpayers can now pay overdue bills, catch up on their property taxes or can undertake car repairs they couldn’t otherwise afford.”

The tax refunds also benefits West Michigan as a whole.

“Our taxpayers have low to moderate incomes and when they receive their refunds or credits, they will spend them locally reinvigorating our West Michigan economy,” Knapp said.

Eligibility and locations

For locations and hours, visit taxhelp.davenport.edu. The income limits for eligibility are $27,000 for individuals and $57,000 for families.

Households earning less than $66,000 can file on their own online at myfreetaxes.com.

No Responses