Appointments available at various locations in Holland, Wyoming and Grand Rapids

It’s tax time! The lead up to April 14 can be stressful for anyone, but especially for those living on tight budgets. Davenport University students are volunteering their time alongside a host of community volunteers at tax assistance centers in West Michigan this year, providing low-income families and individuals assistance with their 2024 tax returns. All volunteers are IRS-certified.

Volunteer Income Tax Assistance program (VITA) partners with community groups to help families, seniors and persons with disabilities e-file their tax returns. They help West Michigan families receive tax refunds and credits that enable them to stay in their homes, feed their families, keep the lights on and save for the future.

“The VITA program is a great opportunity for our Davenport accounting students to receive valuable experience while also helping neighbors in our community seek the help they need,” said Scott Gumieny, CPA, Davenport University accounting instructor. “It’s a great way for Davenport students to give back.”

West Michigan VITA sites are now open. The public is welcome to make an appointment by calling 2-1-1. Services are free to those with an income of $67,000 or lower.

Free online filing is available at My free Taxes if your earnings are below $84,000.

“I got involved with VITA through my honors program project,” said Julia Smith, a Davenport University junior volunteering at St. Alphonsus Parish in Grand Rapids. “It makes me feel good knowing I’m helping people who need the help – knowing we’re helping people in the community.”

Davenport’s Honors Professional Accountancy program requires students to work 60 volunteer hours with a nonprofit. The program provides students with the opportunity to earn a BBA in Honors Professional Accountancy, a Master of Accountancy (MAcc), and a Graduate Certificate in a five-year period. Through the honors program, Smith will graduate in December of 2026 with her master’s degree.

Davenport student Lauren Schwallier, another Honors Professional Accountancy program student, volunteers at The Source, alongside Davenport alumni and former Davenport employees. Schwallier is a senior at Davenport University. She volunteers as a tax preparer 2-3 days a week; and will put in close to 75 hours during this tax season.

“On a normal day I meet with 3 or 4 clients, one per hour,” said Schwallier. “Some are elderly, mid- to low-income, or single parents. All work is reviewed and signed off on before being e-filed. It’s a great opportunity to learn and get your feet wet in the tax industry.”

Participants are encouraged to schedule early, said Gumieny, and keep their appointment. If a cancellation is needed, it should be made early to allow as many individuals as possible to take advantage of the services.

To learn more about Davenport’s Honors Professional Accountancy program, visit https://www.davenport.edu/academics/areas/business/honors-professional-accountancy or call admissions at 800-686-1600.

Share This Story!

Appointments available at various locations in Holland, Wyoming and Grand Rapids

It’s tax time! The lead up to April 14 can be stressful for anyone, but especially for those living on tight budgets. Davenport University students are volunteering their time alongside a host of community volunteers at tax assistance centers in West Michigan this year, providing low-income families and individuals assistance with their 2024 tax returns. All volunteers are IRS-certified.

Volunteer Income Tax Assistance program (VITA) partners with community groups to help families, seniors and persons with disabilities e-file their tax returns. They help West Michigan families receive tax refunds and credits that enable them to stay in their homes, feed their families, keep the lights on and save for the future.

“The VITA program is a great opportunity for our Davenport accounting students to receive valuable experience while also helping neighbors in our community seek the help they need,” said Scott Gumieny, CPA, Davenport University accounting instructor. “It’s a great way for Davenport students to give back.”

West Michigan VITA sites are now open. The public is welcome to make an appointment by calling 2-1-1. Services are free to those with an income of $67,000 or lower.

Free online filing is available at My free Taxes if your earnings are below $84,000.

“I got involved with VITA through my honors program project,” said Julia Smith, a Davenport University junior volunteering at St. Alphonsus Parish in Grand Rapids. “It makes me feel good knowing I’m helping people who need the help – knowing we’re helping people in the community.”

Davenport’s Honors Professional Accountancy program requires students to work 60 volunteer hours with a nonprofit. The program provides students with the opportunity to earn a BBA in Honors Professional Accountancy, a Master of Accountancy (MAcc), and a Graduate Certificate in a five-year period. Through the honors program, Smith will graduate in December of 2026 with her master’s degree.

Davenport student Lauren Schwallier, another Honors Professional Accountancy program student, volunteers at The Source, alongside Davenport alumni and former Davenport employees. Schwallier is a senior at Davenport University. She volunteers as a tax preparer 2-3 days a week; and will put in close to 75 hours during this tax season.

“On a normal day I meet with 3 or 4 clients, one per hour,” said Schwallier. “Some are elderly, mid- to low-income, or single parents. All work is reviewed and signed off on before being e-filed. It’s a great opportunity to learn and get your feet wet in the tax industry.”

Participants are encouraged to schedule early, said Gumieny, and keep their appointment. If a cancellation is needed, it should be made early to allow as many individuals as possible to take advantage of the services.

To learn more about Davenport’s Honors Professional Accountancy program, visit https://www.davenport.edu/academics/areas/business/honors-professional-accountancy or call admissions at 800-686-1600.

Share This Story!

Stay connected!

Get the latest Davenpost News delivered to your inbox!

Related Stories

Davenport University is focused on student mental health, so when it was approached by Corewell Health to participate in its [...]

People choose to attend Davenport University for a variety of reasons. Some seek a degree to continue a family tradition, [...]

Former Davenport University student-athlete, Muskegon native and Grand Haven High School graduate Aaron Cummings will be the first person from [...]

Latest Stories

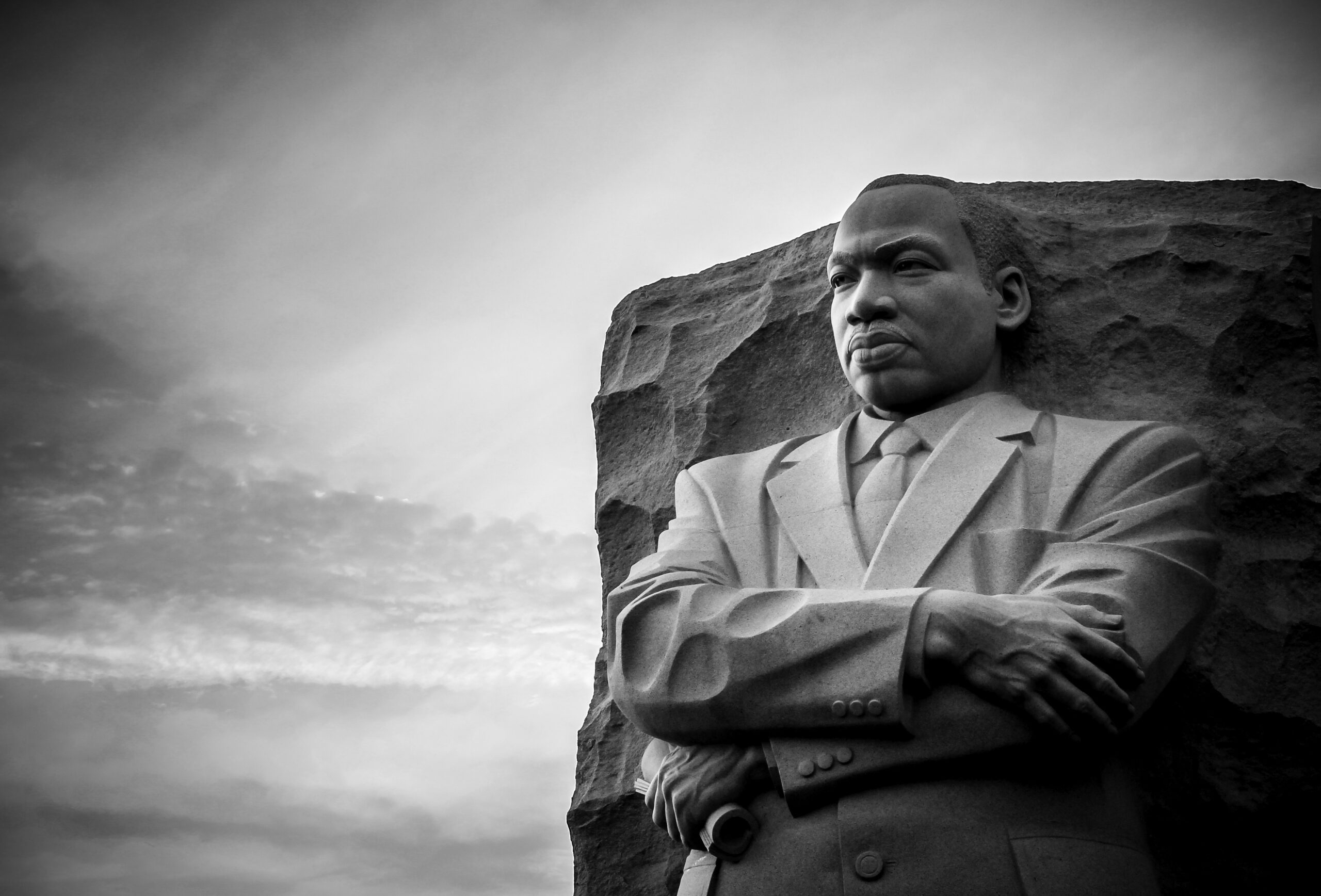

Davenport University partners with Grand Valley State University and Grand Rapids Community College on the community-wide MLK day celebration on [...]

Davenport President Richard J. Pappas addresses attendees. Davenport University leaders, trustees, employees and guests gathered December 10 on [...]

Pictured from left to right: Susan Crkovski, executive campus director-Warren; Davenport student Jeryn Washington, BSN Pre-Licensure program; Davenport student Manar [...]