Appointments available in Holland, Grand Rapids, Grand Haven, Allendale, and Wyoming areas

Today, Davenport University announced it has opened 10 tax assistance centers in Kent and Ottawa Counties, with students and faculty providing low-income families and individuals assistance with their 2021 tax returns. All volunteers are IRS-certified.

Davenport University, the West Michigan VITA Collegiate Partnership, and the IRS-sponsored VITA – Volunteer Income Tax Assistance program, partner with community groups to help families, seniors, and persons with disabilities e-file their tax returns, returning millions of dollars in tax refunds and credits to those who need them the most. The program is open to individuals and families earning $60,000 or less.

“This program is a win-win,” said Dr. Richard J. Pappas, president of Davenport University. “It’s an opportunity for our students to provide a valuable community service, and help our West Michigan neighbors earn their much-needed tax refunds and credits, while also learning valuable skills that align with their career goals.”

This year some individuals will need to file tax returns even if they haven’t had to in the past. Those with low income still need to file to claim a “Recovery Rebate Credit” to receive the tax credit from the 2021 stimulus payments or reconcile advance payments of the child tax credit.

Individuals with earnings that are above $60,000 but below $73,000 can file their federal and state taxes for free by visiting My free Taxes.

Appointments are required and may be secured by visiting taxhelp.davenport.edu or calling 2-1-1 in Kent or Ottawa County. Only the taxpayer and spouse will be allowed to attend the meeting. Residents are encouraged to make appointments early as sites have reduced capacity because of COVID. Masks are required and social distancing will be enforced.

“We help West Michigan families receive tax refunds and credits that enable them to stay in their homes, feed their families, keep the lights on, and save for the future,” said Dr. Richard J. Pappas, president of Davenport University. “With many individuals and families receiving stimulus payments in 2021 or an advance child tax credit, it’s important to understand these changes and account for them to avoid delays with your tax return.”

Participants are encouraged to schedule early and keep their appointment. If a cancellation is needed, it should be made early to allow as many individuals as possible to take advantage of the services.

If you or someone you know could benefit from this program, visit taxhelp.davenport.edu for more information. Appointments can be made now. Those interested can use the website map to find the location nearest them.

Current tax assistance sites include:

- Community Action House – Holland

- Davenport University, Holland

- Four Pointes Center, Grand Haven

- Davenport University Maine College of Business, W.A. Lettinga Campus, Grand Rapids

- Kent County Community Action Center, Grand Rapids

- Alphonsus Parish, Grand Rapids

- Trinity Reformed Church, Grand Rapids

- The Source, Grand Rapids

- Love Inc. Allendale

- Wyoming Public Library, Wyoming

Share This Story!

Appointments available in Holland, Grand Rapids, Grand Haven, Allendale, and Wyoming areas

Today, Davenport University announced it has opened 10 tax assistance centers in Kent and Ottawa Counties, with students and faculty providing low-income families and individuals assistance with their 2021 tax returns. All volunteers are IRS-certified.

Davenport University, the West Michigan VITA Collegiate Partnership, and the IRS-sponsored VITA – Volunteer Income Tax Assistance program, partner with community groups to help families, seniors, and persons with disabilities e-file their tax returns, returning millions of dollars in tax refunds and credits to those who need them the most. The program is open to individuals and families earning $60,000 or less.

“This program is a win-win,” said Dr. Richard J. Pappas, president of Davenport University. “It’s an opportunity for our students to provide a valuable community service, and help our West Michigan neighbors earn their much-needed tax refunds and credits, while also learning valuable skills that align with their career goals.”

This year some individuals will need to file tax returns even if they haven’t had to in the past. Those with low income still need to file to claim a “Recovery Rebate Credit” to receive the tax credit from the 2021 stimulus payments or reconcile advance payments of the child tax credit.

Individuals with earnings that are above $60,000 but below $73,000 can file their federal and state taxes for free by visiting My free Taxes.

Appointments are required and may be secured by visiting taxhelp.davenport.edu or calling 2-1-1 in Kent or Ottawa County. Only the taxpayer and spouse will be allowed to attend the meeting. Residents are encouraged to make appointments early as sites have reduced capacity because of COVID. Masks are required and social distancing will be enforced.

“We help West Michigan families receive tax refunds and credits that enable them to stay in their homes, feed their families, keep the lights on, and save for the future,” said Dr. Richard J. Pappas, president of Davenport University. “With many individuals and families receiving stimulus payments in 2021 or an advance child tax credit, it’s important to understand these changes and account for them to avoid delays with your tax return.”

Participants are encouraged to schedule early and keep their appointment. If a cancellation is needed, it should be made early to allow as many individuals as possible to take advantage of the services.

If you or someone you know could benefit from this program, visit taxhelp.davenport.edu for more information. Appointments can be made now. Those interested can use the website map to find the location nearest them.

Current tax assistance sites include:

- Community Action House – Holland

- Davenport University, Holland

- Four Pointes Center, Grand Haven

- Davenport University Maine College of Business, W.A. Lettinga Campus, Grand Rapids

- Kent County Community Action Center, Grand Rapids

- Alphonsus Parish, Grand Rapids

- Trinity Reformed Church, Grand Rapids

- The Source, Grand Rapids

- Love Inc. Allendale

- Wyoming Public Library, Wyoming

Share This Story!

Stay connected!

Get the latest Davenpost News delivered to your inbox!

Related Stories

Positive Impact in the Classroom: The concentrated effort by all nursing faculty members included providing additional content study sessions for [...]

Davenport University’s free online tutoring services give any undergraduate or graduate student access to help with any subject anytime. Online [...]

Alum inspired by life’s challenges We are honored to feature Linda Monusko ’13 as our Alumni Success Story this week. [...]

Latest Stories

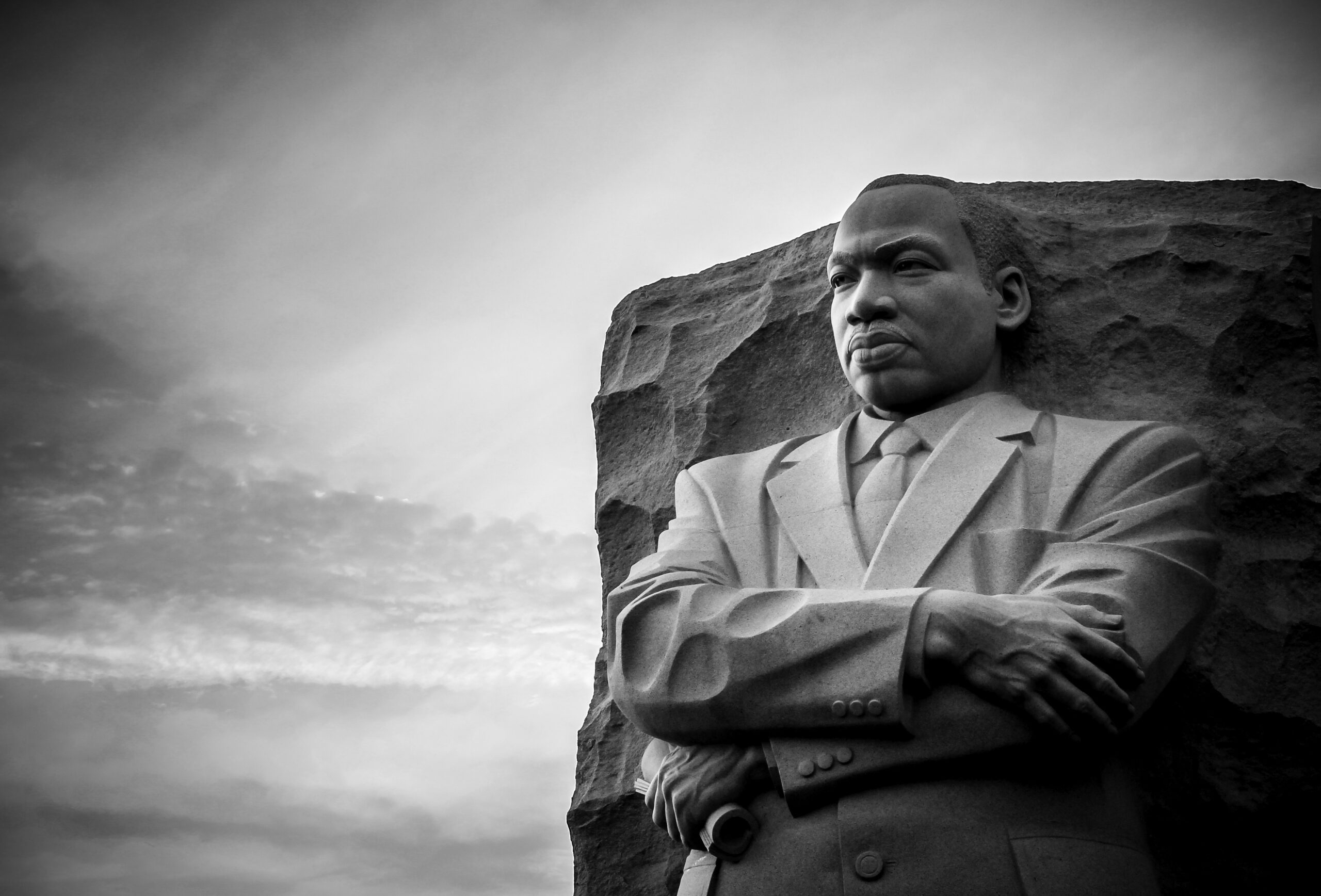

Davenport University partners with Grand Valley State University and Grand Rapids Community College on the community-wide MLK day celebration on [...]

Davenport President Richard J. Pappas addresses attendees. Davenport University leaders, trustees, employees and guests gathered December 10 on [...]

Pictured from left to right: Susan Crkovski, executive campus director-Warren; Davenport student Jeryn Washington, BSN Pre-Licensure program; Davenport student Manar [...]