Davenport University offers free tax assistance to qualifying community members

Every year, millions of dollars in tax refunds and credits go unclaimed by those who need them the most. That’s why Davenport University faculty and accounting students volunteer for the Volunteer Income Tax Assistance (VITA) program, where they help members of the Davenport and surrounding communities file their taxes for free.

So far, VITA has made a significant impact on the students and families in our community. Judy Knapp, director of Davenport’s VITA program, reported that her team served over 6,500 people last year. And, that those 6,500 collectively received over $8 million in tax returns.

Who qualifies for free assistance?

Through VITA, Davenport University students, including international students, and low-income households from surrounding communities can receive free help filing their taxes between January 25 and April 4. To receive this assistance, you must have a household income of less than $27,000 for individuals or $57,000 for families.

Alternatively, students and anyone earning less than $66,000 per year can file taxes using this free online tax tool.

Where are VITA services offered and how can I sign up?

Assistance is offered at locations across West Michigan including Davenport University’s W.A. Lettinga and Holland campuses as well as in Grand Rapids, Wyoming, Hastings, Delton, Plainfield and Nashville, MI. Volunteers at all locations have gone through the IRS-approved training program.

To make an appointment, visit https://taxhelp.davenport.edu/ to find the best location for you and get set up. Once you make an appointment, be sure to check out, What do I need to bring?, so you’re prepared.

Internship opportunities with VITA

VITA can also help Davenport students meet their internship requirements for certain degree plans. Knapp encourages potential applicants to check with their academic advisor to see if an internship with VITA is possible for their degree plan.

It’s important to mention that VITA interns have to be ready to get down to business. As Ashley Mulder, a VITA volunteer and accounting honors student at Davenport, puts it, “It can be a bit nerve-wracking, but it’s a great way to learn how to do taxes and gain experience.”

For more information or to schedule an appointment, please visit: https://taxhelp.davenport.edu/.

Share This Story!

Davenport University offers free tax assistance to qualifying community members

Every year, millions of dollars in tax refunds and credits go unclaimed by those who need them the most. That’s why Davenport University faculty and accounting students volunteer for the Volunteer Income Tax Assistance (VITA) program, where they help members of the Davenport and surrounding communities file their taxes for free.

So far, VITA has made a significant impact on the students and families in our community. Judy Knapp, director of Davenport’s VITA program, reported that her team served over 6,500 people last year. And, that those 6,500 collectively received over $8 million in tax returns.

Who qualifies for free assistance?

Through VITA, Davenport University students, including international students, and low-income households from surrounding communities can receive free help filing their taxes between January 25 and April 4. To receive this assistance, you must have a household income of less than $27,000 for individuals or $57,000 for families.

Alternatively, students and anyone earning less than $66,000 per year can file taxes using this free online tax tool.

Where are VITA services offered and how can I sign up?

Assistance is offered at locations across West Michigan including Davenport University’s W.A. Lettinga and Holland campuses as well as in Grand Rapids, Wyoming, Hastings, Delton, Plainfield and Nashville, MI. Volunteers at all locations have gone through the IRS-approved training program.

To make an appointment, visit https://taxhelp.davenport.edu/ to find the best location for you and get set up. Once you make an appointment, be sure to check out, What do I need to bring?, so you’re prepared.

Internship opportunities with VITA

VITA can also help Davenport students meet their internship requirements for certain degree plans. Knapp encourages potential applicants to check with their academic advisor to see if an internship with VITA is possible for their degree plan.

It’s important to mention that VITA interns have to be ready to get down to business. As Ashley Mulder, a VITA volunteer and accounting honors student at Davenport, puts it, “It can be a bit nerve-wracking, but it’s a great way to learn how to do taxes and gain experience.”

For more information or to schedule an appointment, please visit: https://taxhelp.davenport.edu/.

Share This Story!

Stay connected!

Get the latest Davenpost News delivered to your inbox!

Related Stories

“Davenport University helped me find my purpose,” said Myrna Starr Brown ’14. After nearly two decades as a hair stylist, [...]

Considering both the growing trend in online learning and the need to adapt to new social distancing guidelines amid the [...]

Davenport University President Richard J. Pappas is considered a top “power broker” in West Michigan and was named one of [...]

Latest Stories

The path to college isn’t always easy, and for students of color, it is often littered with roadblocks not present [...]

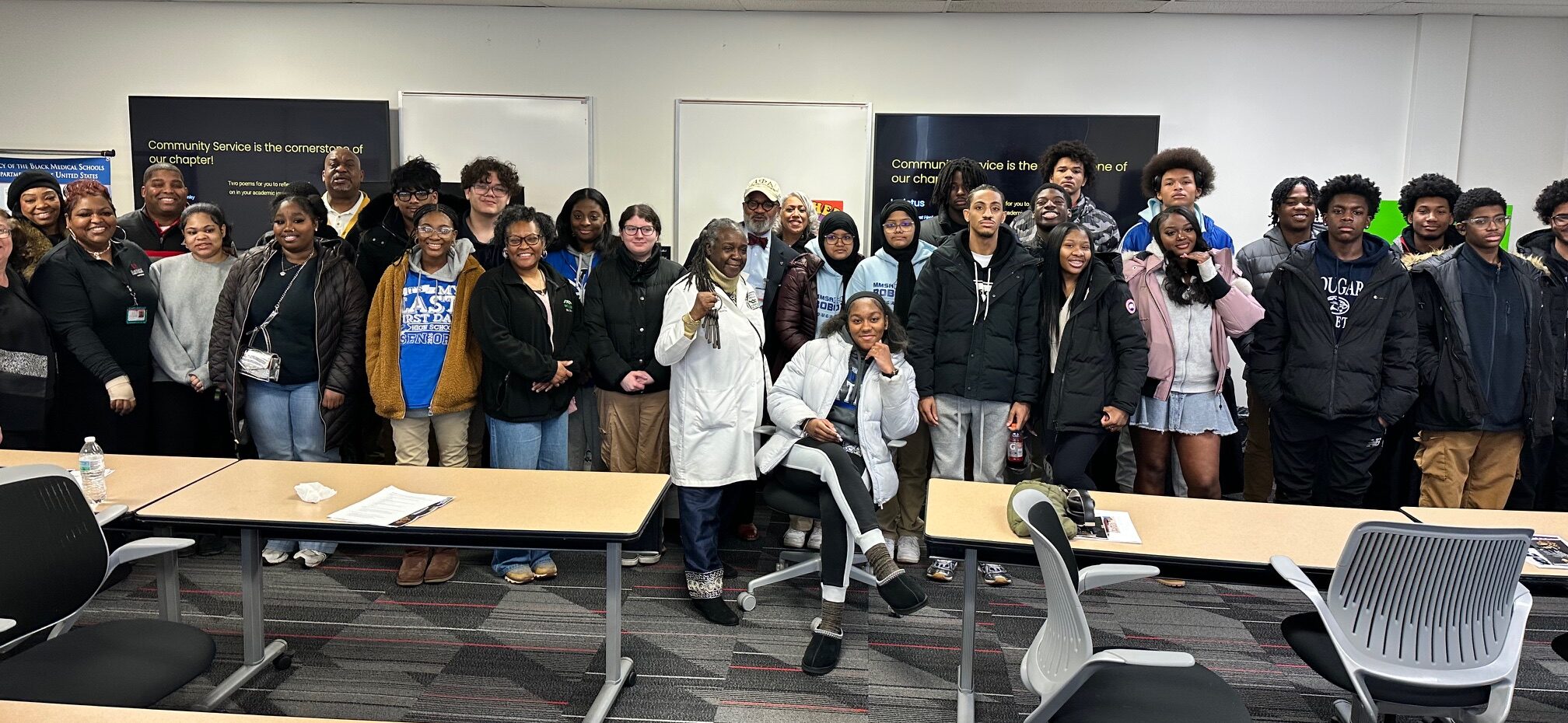

In recognition of Black History Month, Feb. 23 – 26, the Warren campus of Davenport University invited middle and high [...]

Davenport University President Richard J. Pappas, Ed.D., announced that Mark Peters, the CEO of Butterball Farms, Inc. has been appointed [...]